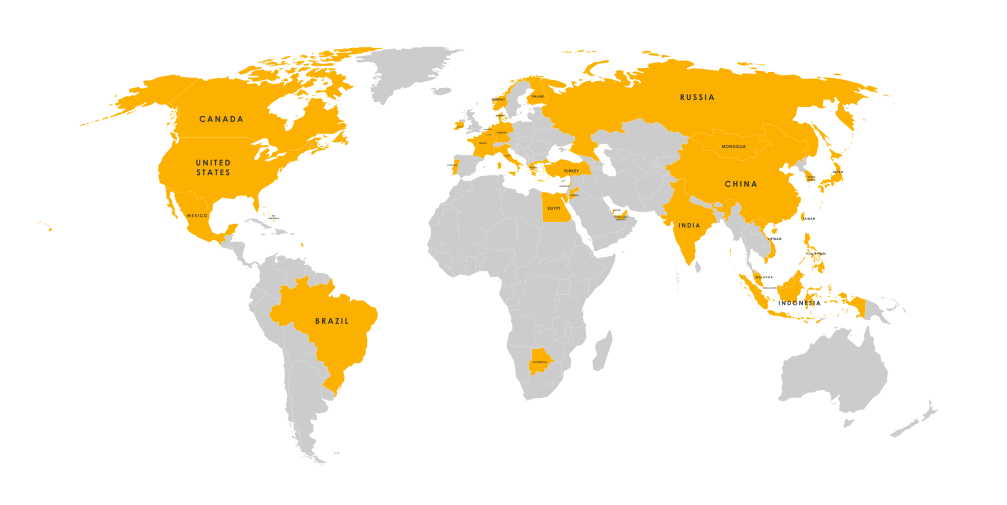

If you have not yet arrived in Canada, you can apply for a bank account online at most major Canadian banks depending on your status as a newcomer and whether you’re coming from a qualifying country. If you have arrived in Canada as a newcomer, you can apply online with your Social Insurance Number (SIN) and a Canadian address.

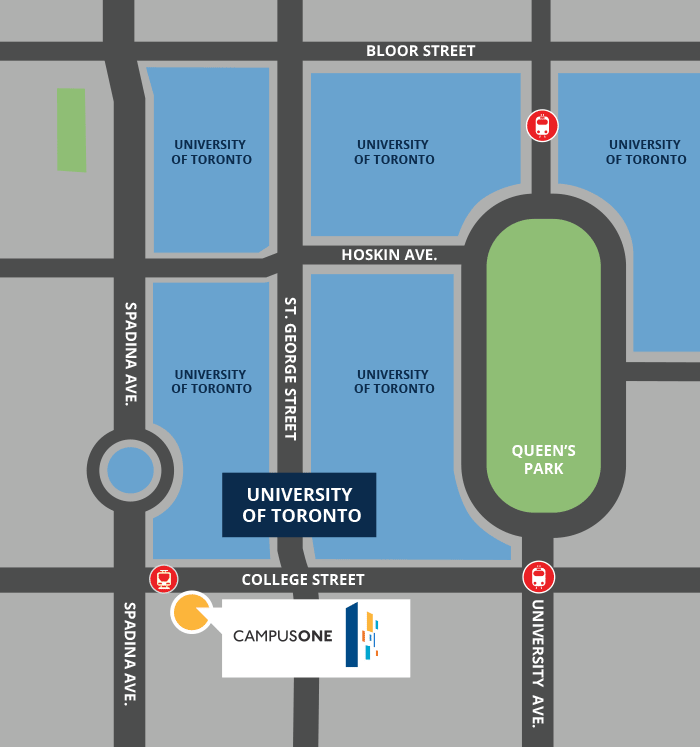

When opening a bank account, be prepared to provide your Canadian Visa or study permit, one piece of government-issued photo ID such as your passport, proof of school registration, and expected graduation date. All of Canada’s major banks have branches in Toronto. When choosing a financial institution that’s right for you, consider their location in proximity to us, hours of operation and online banking features.

When you open your new account, your Canadian bank representative will give or send you a bank card, also known as a 'debit card'. You'll be given a PIN (personal identification number) to access your account through an ATM or debit machine. Your PIN is your only protection against unauthorized use, so do not reveal it to anyone. This debit card allows you to:

- Use Automated Teller Machines (ATMs) for withdrawals, deposits, and bill payments.

- Pay for items at stores and restaurants that accept debit card payments. This is a good alternative if you prefer not to carry too much cash on you.

Another service to consider are credit cards, which allow you to make purchases without carrying cash and giving you a grace period before you have to pay for your purchases. In Canada, banks generally issue one of three credit cards: Visa, MasterCard, or American Express. Visa and MasterCard are accepted at most major stores and restaurants. Credit cards, just like your debit card, will have a PIN (personal identification number) that you should not share with anyone.

If you consider applying for a credit card, understand the terms and conditions of repayment and be certain you can pay your credit card balance on time when your bill arrives. If you do not pay your credit card bill by the due date, the company will charge you interest on the total amount of the bill, regardless of any amount you paid off over the course of the month. You'll also be charged interest on any purchases made after the due date.

At CampusOne Student Residence, we accept Cheque or Money Order which your chosen Canadian financial institution can provide you. Should you opt to make payments online via a credit card, you can make a one-time payment or set up reoccurring monthly payments by clicking “Pay Rent” at the top of our page.